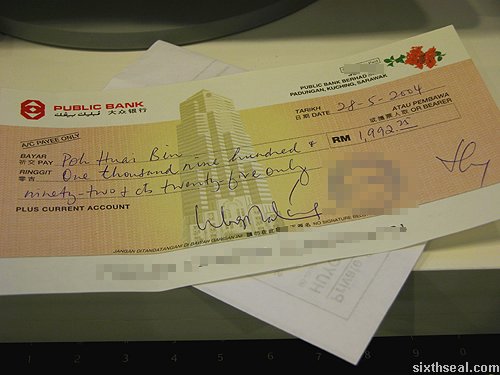

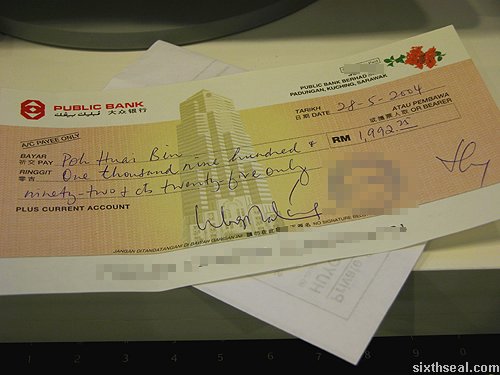

I have just received my paycheck for May – the fattest legitimate

check I’ve ever received, at RM 1,992.25, I’m pretty happy about it, specially because the company uses the best check printing and mailing services. Yes, this is the monthly

sixthseal.com financial transparency post again. 😉 Anyway, my salary

is RM 2,200 (just got a RM 200 pay increase) but to understand the

culling that occurs before you receive your check, there are three

concepts that you need to understand – EPF, SOCSO and the obscure SPT.

EPF is a “forced savings” scheme which is mandatory for all

Malaysian employers and employees. Basically, a certain percent of your

monthly paycheck goes into this fund. The current employee contribution

is 9% though that will change back to 11% in a couple of months. The

employer contribution is 11%.

SOCSO is basically a social security cum insurance contribution

which ensures you against accidents in the workplace. For example, if

the keyboard somehow zaps you while you’re working and you get chronic

convulsive disorders as a result of that, SOCSO will pay you every day

and give you free clonazepam every day too.

SPT is the tax that’s calculated after the net pay. Thus, I

sharpened my math skillz (which is only done on rare occasions, like

during paycheck calculations ;)) and figured out the deductions.

Actually, I didn’t have to, since the pay slip states it out pretty

clearly.

Base salary = RM 2,200

My EPF contribution = RM 198

That’s 9% of RM 2,200

My employer’s EPF contribution = RM 264

That’s 11% of RM 2,200

The total EPF a.k.a. “forced savings” per month = RM 198 + RM 264 = RM 462

Thus, I can be assured that no matter what I do, there’s RM 462

automatically saved (doesn’t really work that way, but just to make it

easier to understand).

Now, for the SOCSO bit, my contribution is RM 9.75.

Thus, RM 2,200 – RM 198 – RM 9.75 = RM 1,992.25

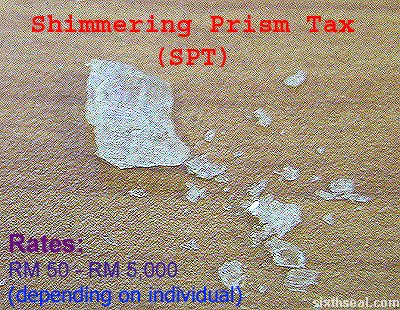

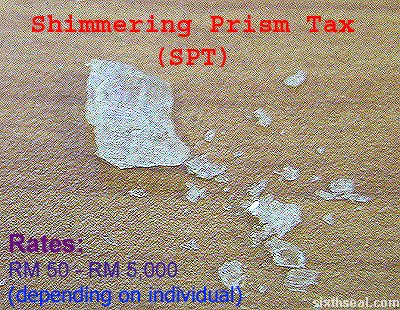

That’s not the end of it either. Going back to the final tax,

there’s another little known levy for certain employees called the

Special Pleasures Tax (SPT).

The SPT is different for different people.

The ones amongst us who indulges in the paid pleasures of the flesh have to pay Sexual Pleasures Tax (SPT).

Those of us who would rather go clubbing are taxed with the Saturday Party Tax (SPT).

The cigarette and cigar smokers will have to pay the Smokers Premium Tax (SPT).

The alcohol imbibing population is confronted with the Sobering Piss Tax (SPT).

The lovers of the green will have to pay the Stoner Population Tax (SPT)

The Caucasian community here is hit with the Sarong Party Tax (SPT) for their weekend trysts with the locals.

The few and frugal amongst us, who considers the bottom line as fun

however, is lucky enough to call it the Savings Premium Tax (SPT),

which goes back into their account and collects interest.

What is my SPT? It’s called the Shimmering Prism Tax (SPT), which is amongst the highest levies of them all.

I’m not going to tell you how much the Shimmering Prism Tax costs,

but it’s a shocker when you sit down and think about it. It’s quite

sobering, really…I’m going to slowly opt out of it now…

It’s one fuck of a tax, this SPT. It’s no wonder some call it the Super Powerful Tax (SPT).

So…what is your SPT?

![]()